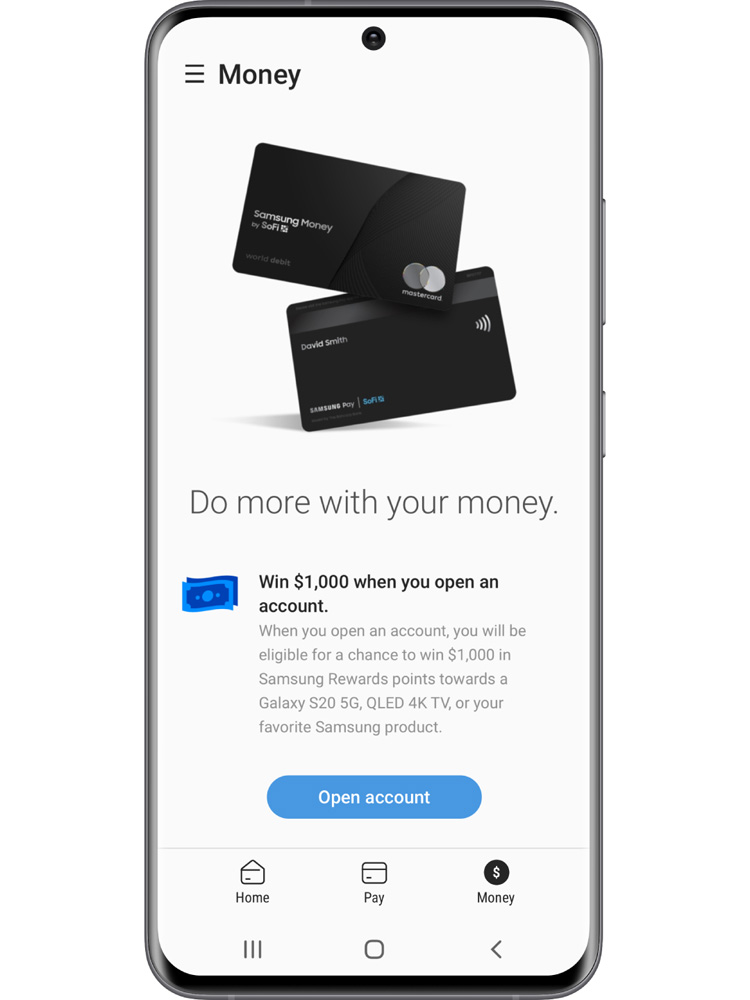

Earlier this month, Samsung confirmed a physical debit card solution for the US market and now they have confirmed more details about the new financial product – Samsung Money.

In partnership with SoFi and Mastercard, Samsung Money is a physical debit card and an extension to Samsung Pay. Samsung is trying to lure customers with no fees for opening and maintaining an account but also get higher interest on the money parked with them and more imporantly, managing the whole experience from the Samsung Pay app.

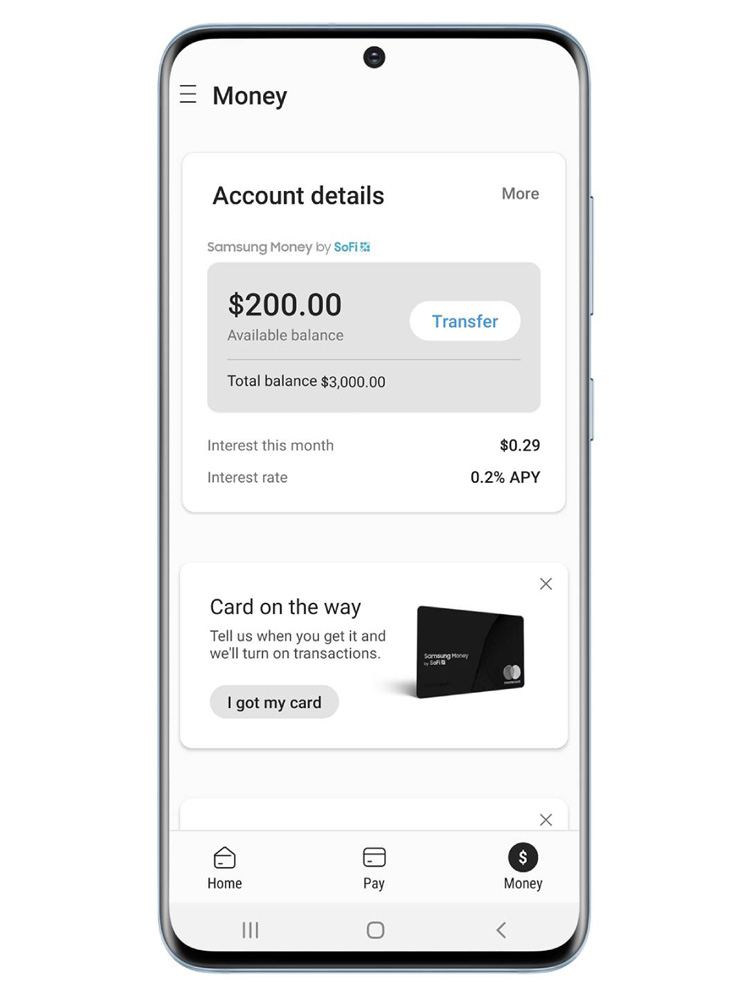

Eligible users will be able to get their Samsung Money card by applying in the Samsung Pay app wherein they can start using instantly with the virtual card while a physical one will reach in the mail in the coming days that can be used to withdraw money from ATM.

The Samsung Pay app will act as a gateway for all things Samsung Money, which includes checking their balance, review past statements, and search transactions. Users can also flag suspicious activity, pause or restart spending, freeze or unfreeze their card, change their pin, assign a trusted contact right from Samsung Pay.

The exclusive benefit of using Samsung Money is that users can enroll in the Samsung Rewards program to earn points for every purchase and once you have accumulated 1,000 or more Samsung Rewards Points, they will be able to redeem it into the Samsung Money account.

Samsung is also assuring users with security. All Samsung Money accounts are FDIC insured for up to $1.5 million, which is six times that of a normal bank account. Moreover, the card is protected with Samsung Knox on the phone and the physical card does not display any sensitive information like the card number, expiration date, or CVC, which is safely stored in the “Money” tab of the Samsung Pay app.

Samsung Money is specific to US currently with no clear plans to introduce in other countries with another local partner but Americans can join the waitlist now before it goes live later this summer.

Leave a Reply